The first shift started over a decade ago, when the Indian consumer started shifting from shopping in local kirana stores to “Modern Trade” channels such as Dmart, Reliance Smart for value purchases.

The second big shift occurred post COVID-19, as internet usage skyrocketed due to cheap data and convenience took precedence due to social distancing norms. Direct to Consumer (D2C) trends took centerstage as they understood consumer preferences better by harnessing users’ digital footprint, This in turn led to D2C revolution giving birth to brands like Mamaearth, Minimalist, BBetter, Plum etc.

The third big shift is underway with Quick-Commerce companies like Blinkit, Zepto, Instamart becoming common names among Indian households, who give more importance to convenience and timeliness. But how did they do so? They cracked the code through “Dark Stores”.

These trends have significant impact on our thinking about brands, distribution and consumer behavior and our portfolio positioning.

We had a 2-hour long discussion with a Growth Manager at Blinkit (Zomato-owned company) to understand the operations and unit economics of these dark stores. The key takeaways from the discussion were:

- A store caters 2-3km radius neighbourhood and breaks even at 1200-1300 orders per day

- Average order value of these Q-Commerce companies ranges between INR450-650

- Considering that the unit economics work out well, these companies have started inviting partners who can franchise these dark stores

- For Blinkit, a partner will have to invest 80 Lakhs (8 lakhs franchise fee+72 lakhs refundable security deposit). The inventory management, logistics etc. will be taken care by Blinkit while the franchise partner will be responsible of the operations within the store

- Win-Win situation: We find this a lucrative investment (ROCEs in excess of 30%) for the franchisee and a mode to accelerate growth for the Q-commerce companies;

- Break-even daily orders for franchisee: 1000 orders per day (conservative assumptions)

- The technology stack developed by Blinkit remotely tracks every activity and ensures that goods are off the store in 2.5 minutes

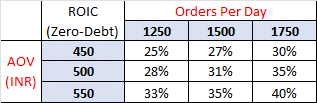

- Big takeway: Qcommerce is now firmly establishing itself as an alternative distribution channel for Consumer companies. Our estimates of ROIC sensitivity below:

Detailed report on Blinkit’s operations and unit economics can be made available, on request.